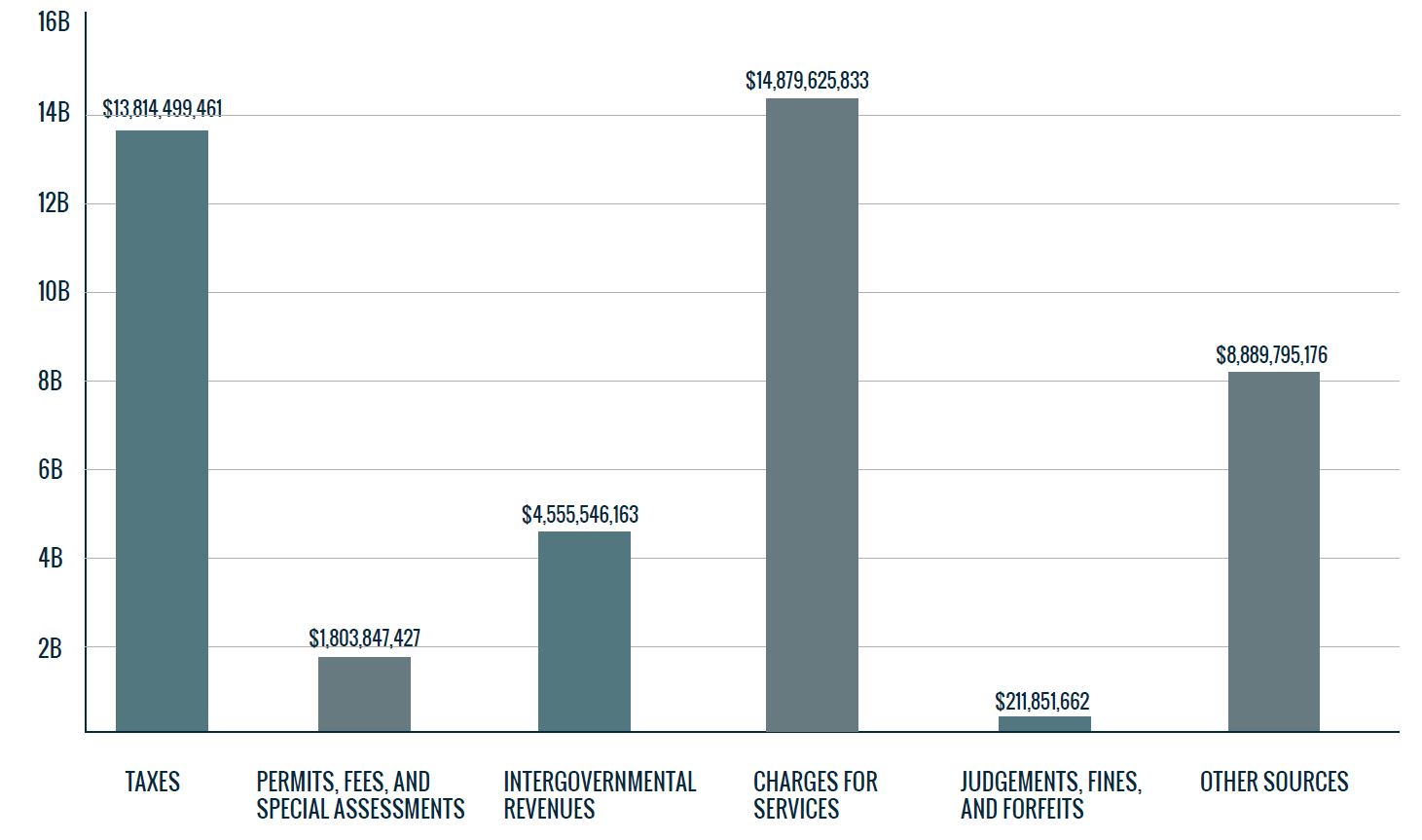

Taxes (which mostly consist of property taxes) and charges account for more than 60 percent of county government revenues statewide. Charges for services include fees and other charges pertaining to any of the multitude of services provided by county governments, including utilities, inspections, tolls, library services, and court services, just to name a select few. Other sources of revenue most often include proceeds from sales and refunds and donations from public and private contributors.

Source: Data compiled by FAC from the Florida Department of Financial Services – Local Government Financial Reporting at: https://apps.fldfs.com/LocalGov/Reports/AdHoc.aspx.