2021 County Revenues & Expenditures: Intergovernmental Revenue

Intergovernmental Revenue includes all revenues from federal, state and other local government sources. These funds came in the form of grants, shared revenues, and payments in lieu of taxes.

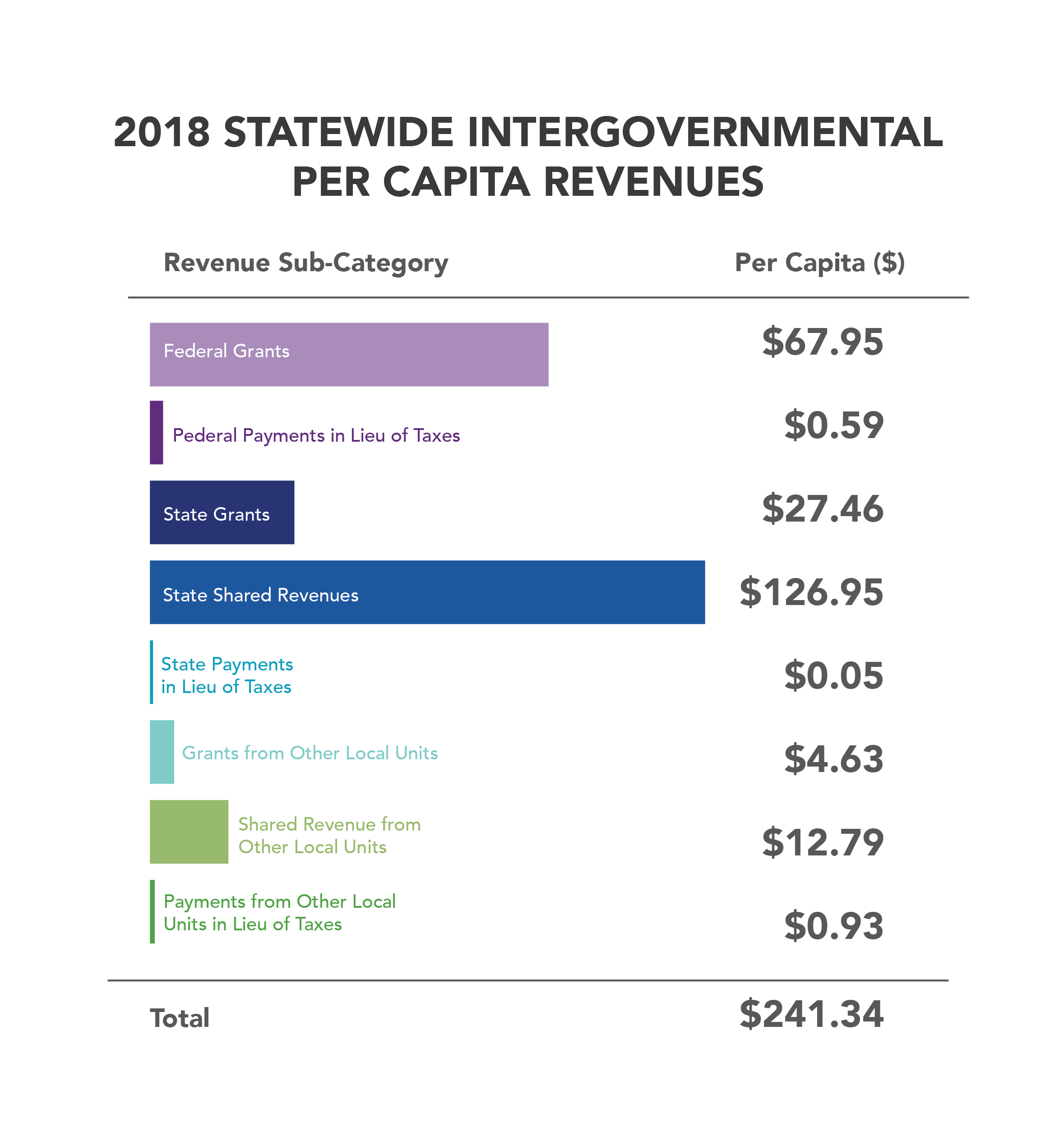

In FY 2018, Intergovernmental Revenue accounted for $5,029,701,554, or 10.18% of all statewide revenues for Florida’s counties, the fourth largest revenue category. The statewide average percentage share was equal to 18.87%, when comparing Intergovernmental Revenue to all revenues on a county-by-county basis. The total per capita receipts for Intergovernmental Revenue was equal to $241.34 per person statewide. This represents an increase of $299,913,041, or 6.34% from the previous f iscal year. The total per capita receipts for Intergovernmental revenues increased by $10.44, or 4.52% from the previous fiscal year.

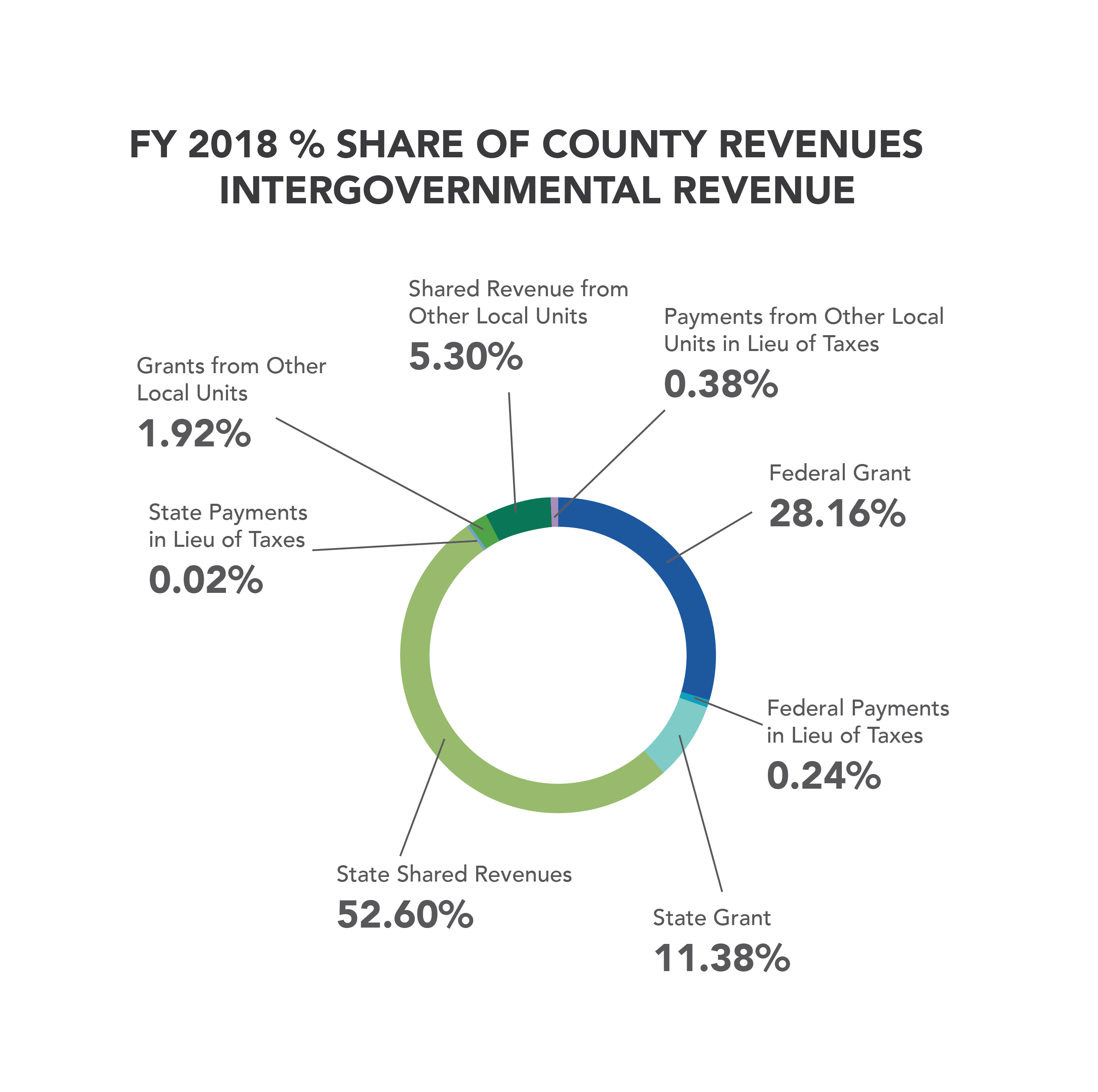

The majority of all intergovernmental revenue was concentrated within two revenue categories statewide: State Shared Revenues and Federal Grants. These categories accounted for about 81% of total Intergovernmental revenue, $194.90 in per capita revenues for FY 2018.

Over half of all Intergovernmental revenues collected (52.60%) was State Shared Revenues. The total per capita receipts for State Shared Revenues was $126.95. State Shared Revenues include but are not limited to the County Revenue Sharing Program, and the Half-Cent Sales Tax Program.

Federal grants revenue accounted for the second highest revenue category at 28.16%, while State Grants follow at 11.38% of statewide Intergovernmental Revenues. The total per capita receipts for Federal grants revenue was $67.95 and $27.46 for State Grants revenue.

Shared Revenue from Other Local Units accounted for the fourth highest revenue category at 5.30%, while Grants from Other Local Units follow at 1.92% of statewide Intergovernmental Revenues. The total per capita receipts for Shared Revenue from Other Local Units was $12.79 and $4.63 for Grants from Other Local Units revenue.

Payments from Other Local Units, State, and Federal in Lieu of Taxes revenue collectively accounted for less than 1% of the total Intergovernmental Revenue. The total per capita receipts for Payments from Other Local Units in Lieu of Taxes was $0.93, while Federal and State Payments in Lieu of Taxes were $0.59 and $0.05 respectively on a per capita basis.

Over half of all Intergovernmental revenues collected (52.60%) was State Shared Revenues. The total per capita receipts for State Shared Revenues was $126.95. State Shared Revenues include but are not limited to the County Revenue Sharing Program, and the Half-Cent Sales Tax Program.

Federal grants revenue accounted for the second highest revenue category at 28.16%, while State Grants follow at 11.38% of statewide Intergovernmental Revenues. The total per capita receipts for Federal grants revenue was $67.95 and $27.46 for State Grants revenue.

Shared Revenue from Other Local Units accounted for the fourth highest revenue category at 5.30%, while Grants from Other Local Units follow at 1.92% of statewide Intergovernmental Revenues. The total per capita receipts for Shared Revenue from Other Local Units was $12.79 and $4.63 for Grants from Other Local Units revenue.

Payments from Other Local Units, State, and Federal in Lieu of Taxes revenue collectively accounted for less than 1% of the total Intergovernmental Revenue. The total per capita receipts for Payments from Other Local Units in Lieu of Taxes was $0.93, while Federal and State Payments in Lieu of Taxes were $0.59 and $0.05 respectively on a per capita basis.