Intergovernmental Revenue included all revenues from federal, state and other local government sources. These funds came in the form of grants, shared revenues, and payments in lieu of taxes.

In FY 2017, Intergovernmental Revenue accounted for 10.21% of all statewide revenues for Florida’s counties, the fourth largest revenue category. The statewide average percentage share was equal to 19.3%, when comparing Intergovernmental Revenue to all revenues on a county-by-county basis. The total per capita receipts for Intergovernmental Revenue was equal to $230.90 per person statewide.

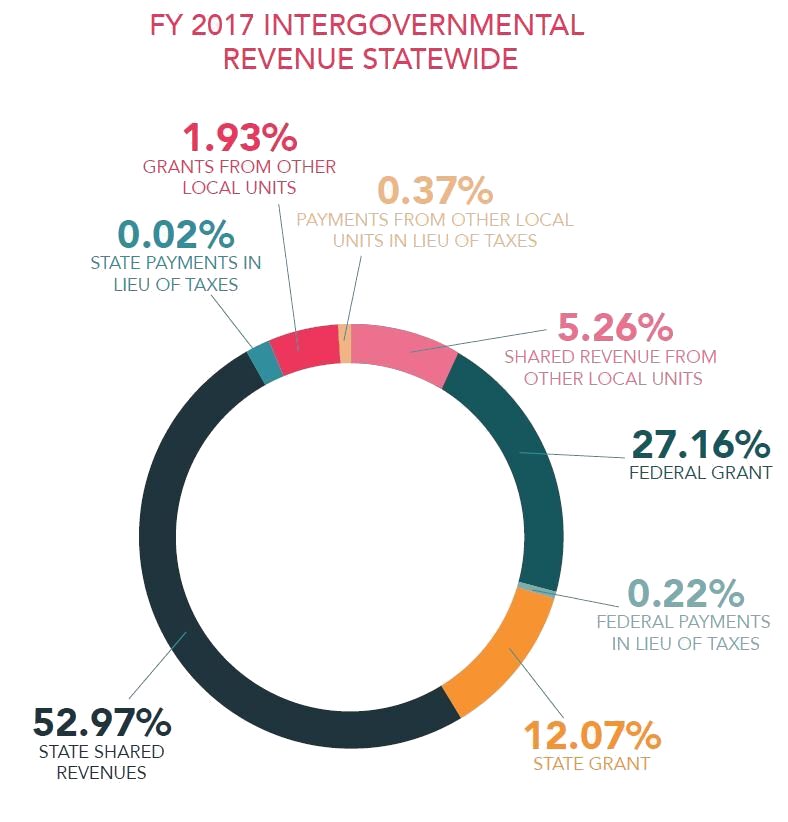

The majority of all intergovernmental revenue was concentrated within two revenue categories statewide: State Shared Revenues and Federal Grants. These categories accounted for about 80% of total Intergovernmental revenue, $185.03 in per capita revenues for FY 2017.

Nearly half of all Intergovernmental revenues collected (52.97%) was State Shared Revenues. The total per capita receipts for State Shared Revenues was $122.31. State Shared Revenues include but are not limited to the County Revenue Sharing Program, and the Half-Cent Sales Tax Program.

In FY 2017, Intergovernmental Revenue accounted for 10.21% of all statewide revenues for Florida’s counties, the fourth largest revenue category. The statewide average percentage share was equal to 19.3%, when comparing Intergovernmental Revenue to all revenues on a county-by-county basis. The total per capita receipts for Intergovernmental Revenue was equal to $230.90 per person statewide.

The majority of all intergovernmental revenue was concentrated within two revenue categories statewide: State Shared Revenues and Federal Grants. These categories accounted for about 80% of total Intergovernmental revenue, $185.03 in per capita revenues for FY 2017.

Nearly half of all Intergovernmental revenues collected (52.97%) was State Shared Revenues. The total per capita receipts for State Shared Revenues was $122.31. State Shared Revenues include but are not limited to the County Revenue Sharing Program, and the Half-Cent Sales Tax Program.

Shared Revenue from Other Local Units accounted for the fourth highest revenue category at 5.26%, while Grants from Other Local Units, follow at 1.937% of statewide Intergovernmental Revenues. The total per capita receipts for Shared Revenue from Other Local Units was $12 and $4.46 for Grants from Other Local Units revenue.

Payments from Other Local Units, State Payment in Lieu of Taxes, and Federal in Lieu of Taxes revenue collectively accounted for less than 1% of the total Intergovernmental Revenue. The total per capita receipts for payment from Other Local Units, State Payment in Lieu of Taxes and Federal Payment in Lieu of Taxes was $0.86, $0.50 and $0.05 respectively.

Payments from Other Local Units, State Payment in Lieu of Taxes, and Federal in Lieu of Taxes revenue collectively accounted for less than 1% of the total Intergovernmental Revenue. The total per capita receipts for payment from Other Local Units, State Payment in Lieu of Taxes and Federal Payment in Lieu of Taxes was $0.86, $0.50 and $0.05 respectively.