2021 County Revenues & Expenditures: Miscellaneous

Miscellaneous revenues are considered a collection of funding sources that do not have an overarching theme. These revenues are categorized together into subcategories in some instances or may be purely financial in nature such as interest earned on accounts, pension contributions, rent, royalties, and private donations to local governments.

In FY 2018, Miscellaneous revenue accounted for $1,995,936,575, 4.04% of all statewide revenues for Florida’s counties, the second smallest revenue category. The statewide average percentage share is equal to 3.68%, when comparing Miscellaneous revenue to all revenues on a county-by-county basis. The total per capita receipts for Miscellaneous revenue was equal to $95.77 per person statewide. This represents a decrease of $26,364,323, or 1.30% from the previous fiscal year. The total per capita receipts for Miscelleanous revenues decreased by $2.95, or 2.99% from the previous fiscal year.

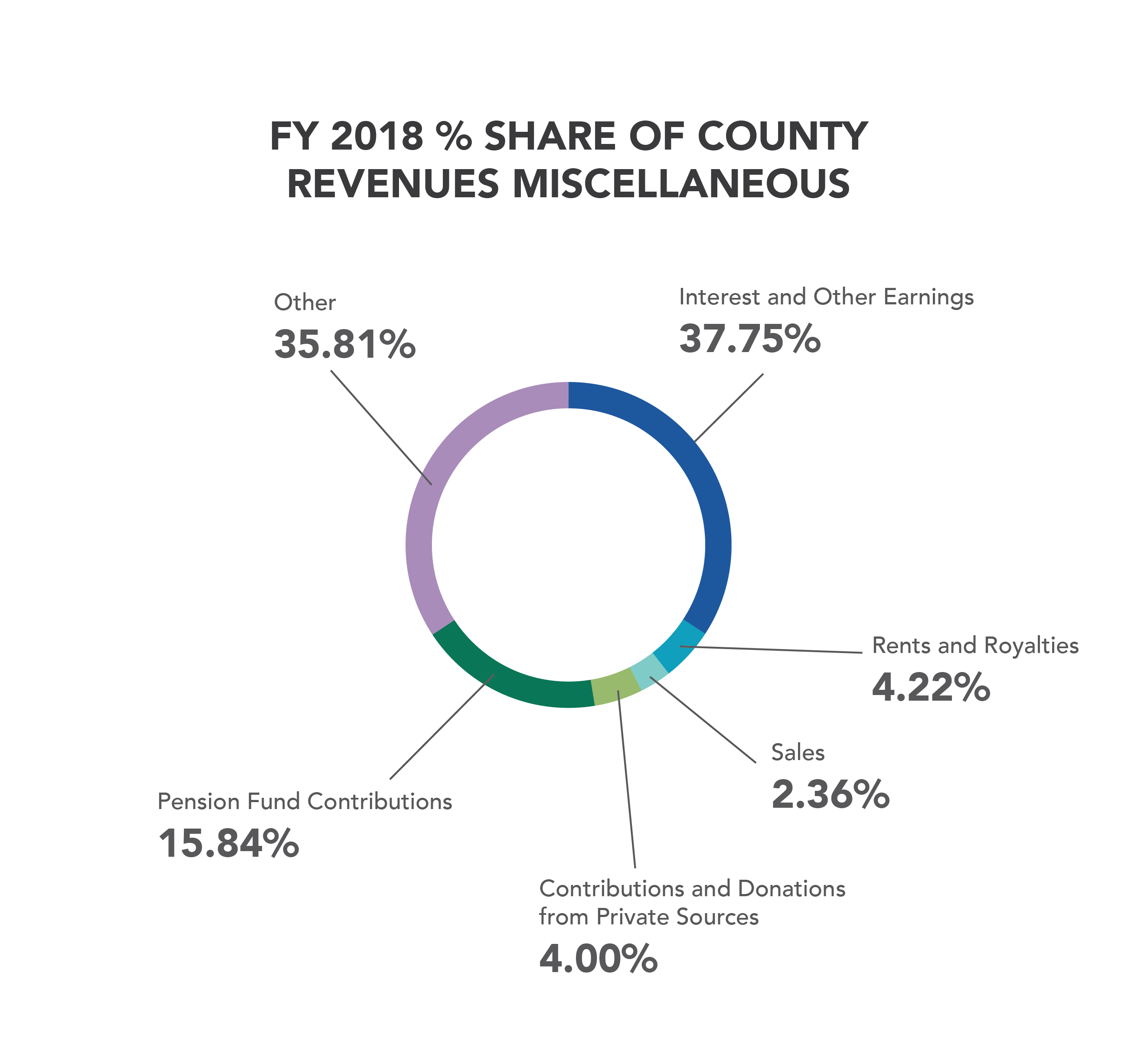

Nearly all Miscellaneous revenues were concentrated within three revenue categories statewide: Interest & Other Earnings, Other Revenue, and Pension Fund Contributions. These three categories accounted for about 89% of total Miscellaneous receipts, $85.63 in per capita revenues for FY 2018.

More than one third of all Miscellaneous revenues collected (37.75%) were Interest & Other Earnings. The total per capita receipts was $36.16. Interest & Other Earnings collectively represent a return on county investments.

Other Miscellaneous revenue accounted for the second highest revenue category at 35.81%, while Pension Fund Contributions followed at 15.84% of statewide Miscellaneous revenues. The total per capita receipts for Other Miscellaneous revenues was $34.30 and $15.17 for Pension Fund Contributions revenues. Other Miscellaneous revenue included settlements, slot machine proceeds, and deferred compensation contributions.

The revenue categories of Rents & Royalties, Contributions & Donations from Private Sources, and Sales receipts collectively accounted for 10.59% of the total Miscellaneous revenues. The total per capita receipts for Rents & Royalties, Contributions & Donations from Private Sources, and Sales was $4.05, $3.83, and $2.26 respectively.

More than one third of all Miscellaneous revenues collected (37.75%) were Interest & Other Earnings. The total per capita receipts was $36.16. Interest & Other Earnings collectively represent a return on county investments.

Other Miscellaneous revenue accounted for the second highest revenue category at 35.81%, while Pension Fund Contributions followed at 15.84% of statewide Miscellaneous revenues. The total per capita receipts for Other Miscellaneous revenues was $34.30 and $15.17 for Pension Fund Contributions revenues. Other Miscellaneous revenue included settlements, slot machine proceeds, and deferred compensation contributions.

The revenue categories of Rents & Royalties, Contributions & Donations from Private Sources, and Sales receipts collectively accounted for 10.59% of the total Miscellaneous revenues. The total per capita receipts for Rents & Royalties, Contributions & Donations from Private Sources, and Sales was $4.05, $3.83, and $2.26 respectively.