Miscellaneous revenues are to be considered a collection of various funding sources that do not have an overarching theme. These revenues are able to be categorized together into subcategories in some instances, or may be purely financial in nature such as interest earned on accounts, pension contributions, rent, royalties, and private donations to local governments.

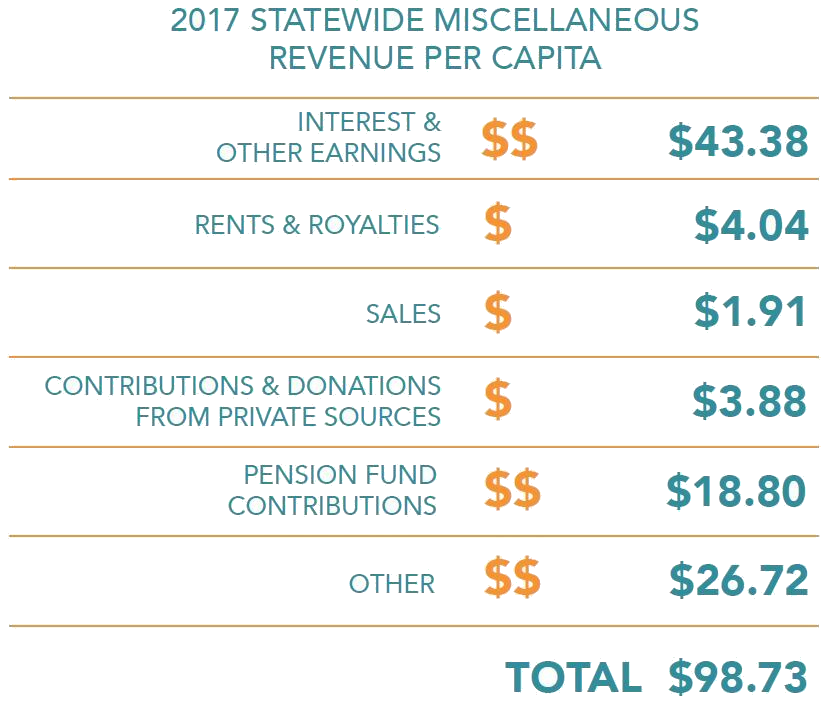

In FY 2017, Miscellaneous revenue accounted for 4.37% of all statewide revenues for Florida’s counties, the third smallest revenue category. The statewide average percentage share is equal to 3.52%, when comparing Miscellaneous revenue to all revenues on a county-by-county basis. The total per capita receipts for Miscellaneous revenue was equal to $98.73 per person statewide.

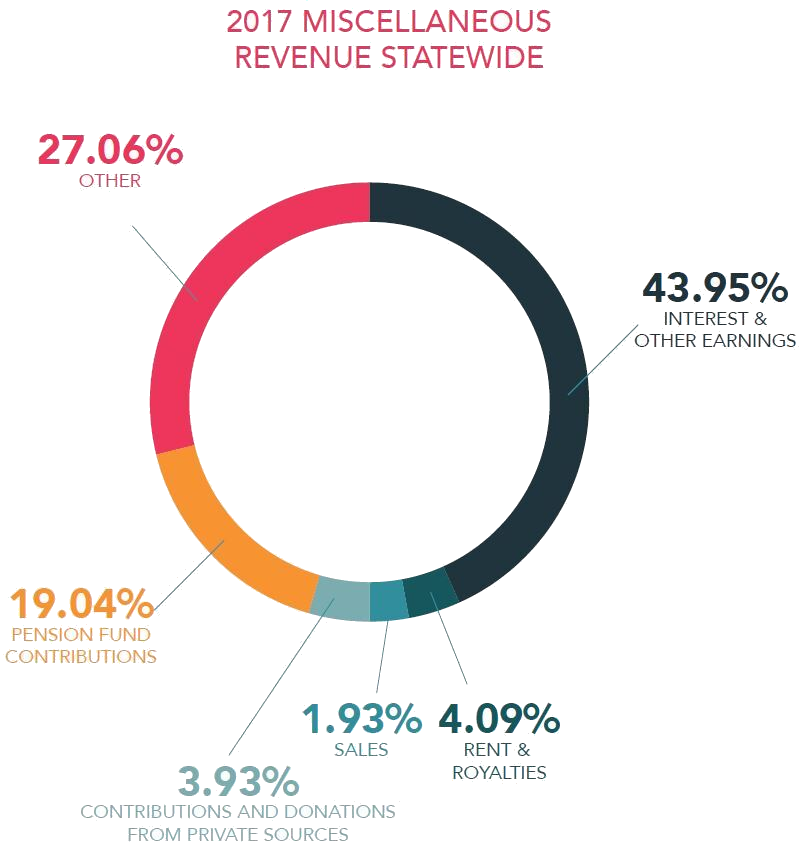

Nearly all Miscellaneous revenues were concentrated within three revenue categories statewide: Interest & Other Earnings, Other Revenue, and Pension Fund Contributions. These three categories accounted for about 90% of total Miscellaneous receipts, $89.10 in per capita revenues for FY 2017.

In FY 2017, Miscellaneous revenue accounted for 4.37% of all statewide revenues for Florida’s counties, the third smallest revenue category. The statewide average percentage share is equal to 3.52%, when comparing Miscellaneous revenue to all revenues on a county-by-county basis. The total per capita receipts for Miscellaneous revenue was equal to $98.73 per person statewide.

Nearly all Miscellaneous revenues were concentrated within three revenue categories statewide: Interest & Other Earnings, Other Revenue, and Pension Fund Contributions. These three categories accounted for about 90% of total Miscellaneous receipts, $89.10 in per capita revenues for FY 2017.

Almost half of all Miscellaneous revenues collected (43.95%) were Interest & Other Earnings. The total per capita receipts was $43.38. Interest & Other Earnings collectively represent a return on county investments.

Other Miscellaneous revenue accounted for the second highest revenue category at 27.06%, while Pension Fund Contributions follow at 19.04% of statewide Miscellaneous revenues. The total per capita receipts for Other Miscellaneous revenues was $26.72 and $18.80 for Pension Fund Contributions revenues. Other Miscellaneous revenue included settlements, slot machine proceeds, and deferred compensation contributions.

The revenue categories of Rents & Royalties, Contributions & Donations from Private Sources, and Sales receipts collectively accounted for 9.95% of the total Miscellaneous revenues. The total per capita receipts for Rents & Royalties, Contributions & Donations from Private Sources, and Sales was $4.04, $3.88, and $1.91 respectively.

Other Miscellaneous revenue accounted for the second highest revenue category at 27.06%, while Pension Fund Contributions follow at 19.04% of statewide Miscellaneous revenues. The total per capita receipts for Other Miscellaneous revenues was $26.72 and $18.80 for Pension Fund Contributions revenues. Other Miscellaneous revenue included settlements, slot machine proceeds, and deferred compensation contributions.

The revenue categories of Rents & Royalties, Contributions & Donations from Private Sources, and Sales receipts collectively accounted for 9.95% of the total Miscellaneous revenues. The total per capita receipts for Rents & Royalties, Contributions & Donations from Private Sources, and Sales was $4.04, $3.88, and $1.91 respectively.