Background

The NFIP is a Federal program created by Congress to mitigate future flood losses nationwide through sound, community-enforced building and zoning ordinances and to provide access to affordable, federally backed flood insurance protection for property owners. The NFIP is designed to provide an insurance alternative to disaster assistance to meet the escalating costs of repairing damage to buildings and their contents caused by floods.

Participation in the NFIP is based on an agreement between local communities and the Federal Government that states that if a community will adopt and enforce a floodplain management ordinance to reduce future flood risks to new construction in Special Flood Hazard Areas (SFHAs), the Federal Government will make flood insurance available within the community as a financial protection against flood losses.

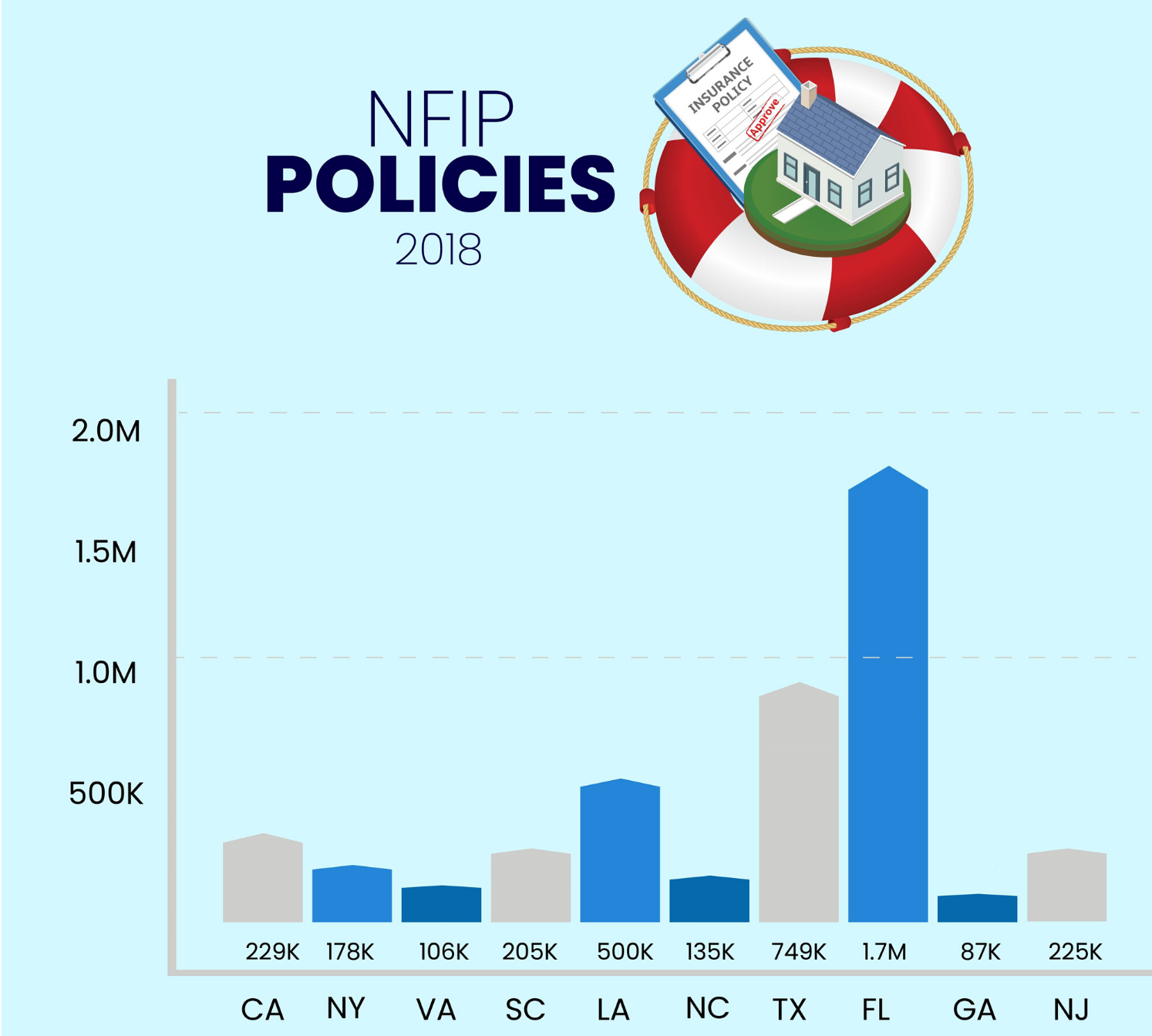

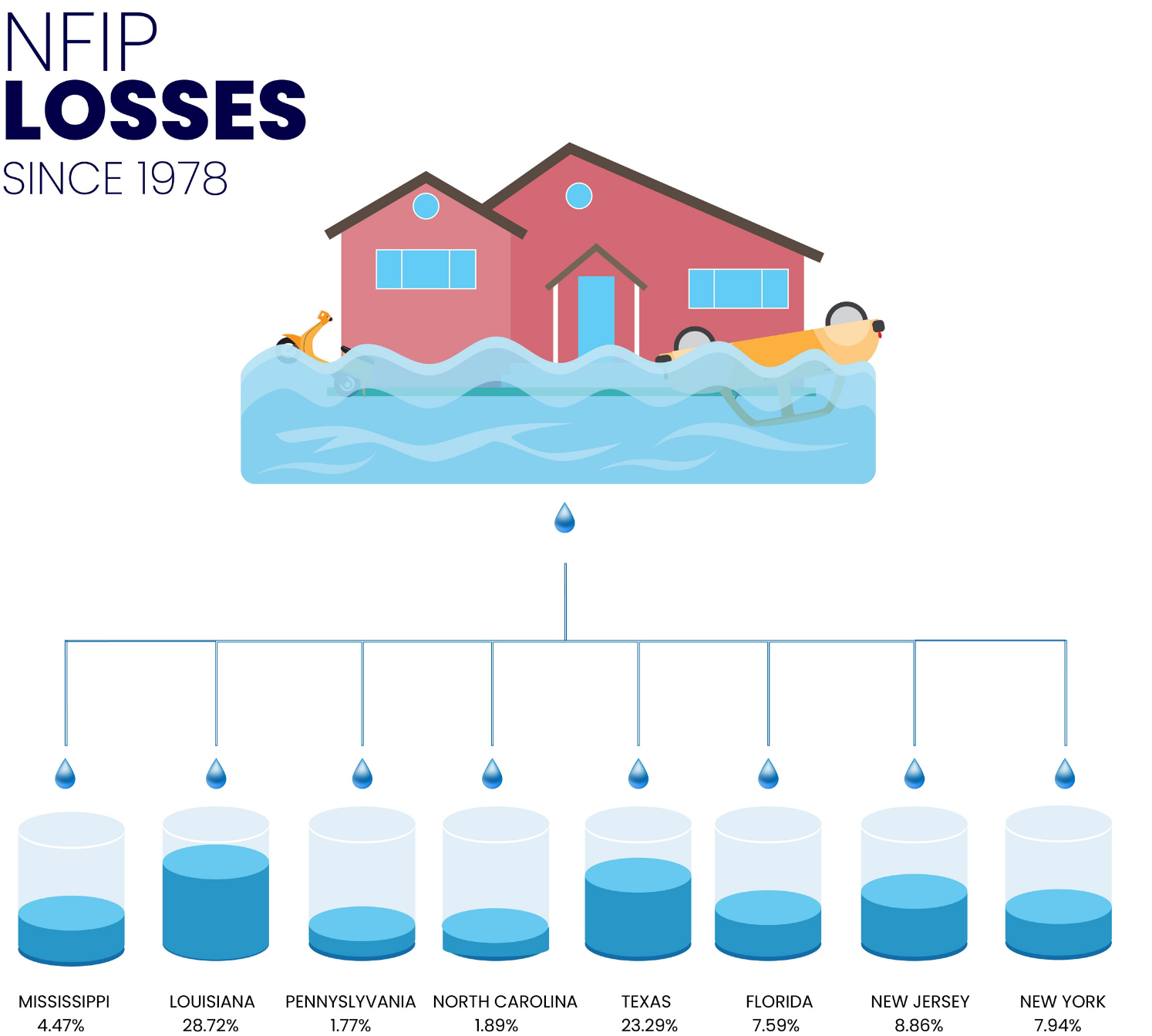

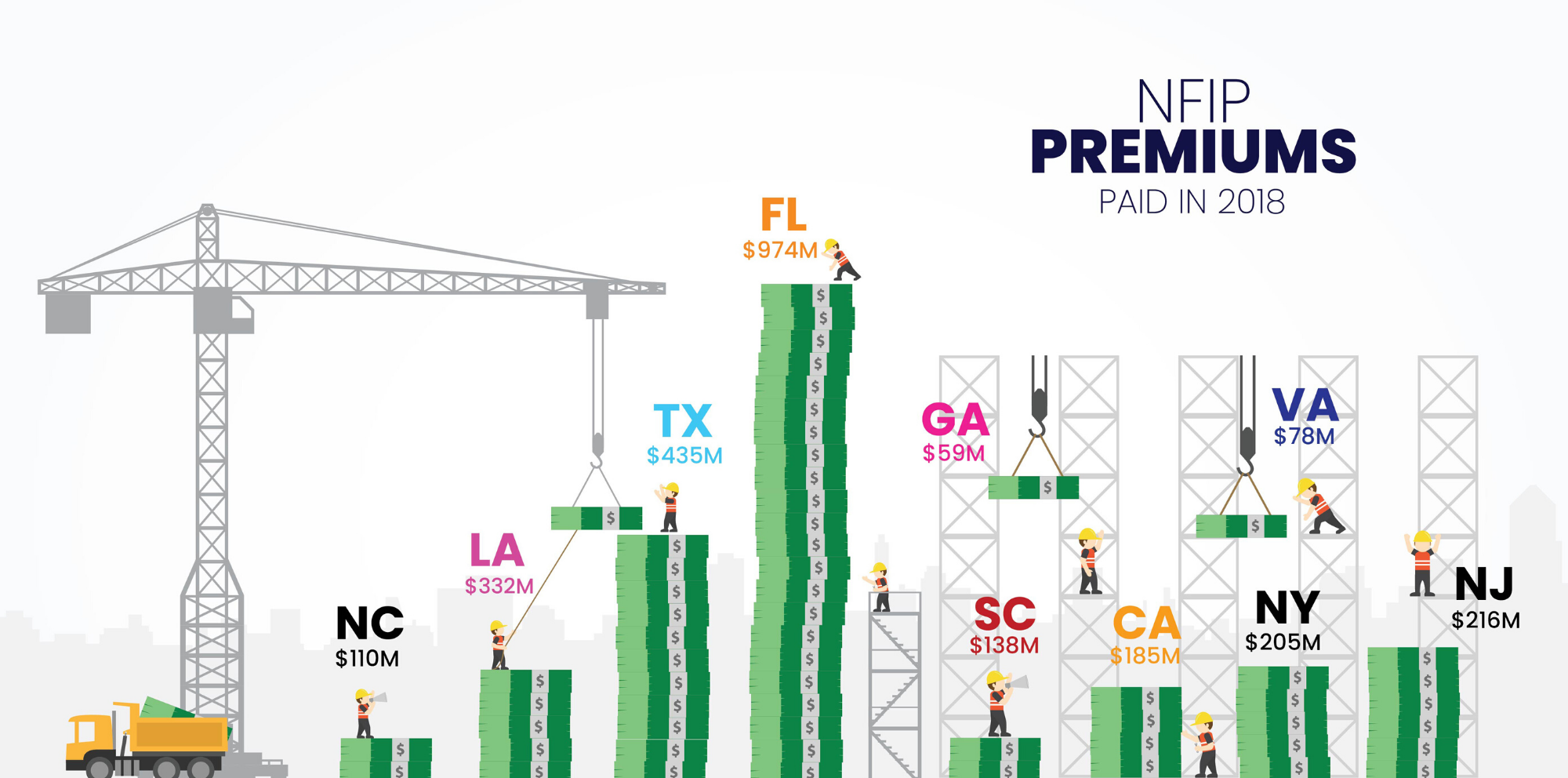

Florida is an important state within the NFIP, as it holds one-third of all policies nationwide (1.77 million out of 5.5 million). For the current year, more than $974 million in premiums will be paid by Florida policy holders. Since 1978, the NFIP has paid more than $38 billion in claims to flood victims, with some 40 percent being paid to Louisiana residents after Hurricane Katrina. In contrast, during the same period, Florida has received $3.6 billion in payouts.

NFIP is reauthorized every three years. In 2012, it was reauthorized through the Biggert-Waters Flood Insurance Reform Act (BW-12) which sought to eliminate the NFIP deficit simply by increasing premiums. The result was that many homeowners saw their premiums escalate to unaffordable amounts. In one case, the premium on a $300,000 home increased from $1,900 to over $49,000.

To address this crisis, the Homeowners Flood Insurance Affordability Act (HFIAA) was passed in 2014. Through HFIAA, rate increases were capped at no more than 18% annually for residential and 25% for commercial properties. For Florida, the 2014 law should be viewed as only a marginal repair to the 2012 reauthorization. For example, the NFIP provides a reduced – or preferred rate – for properties that were built before 1975, when flood maps were not available. However, the 2014 reauthorization left unchanged a modification that does not extend this rate to non-primary residences (i.e., vacation rentals, investment properties, and businesses), which will receive annual 25 percent premium increases until full-risk rates are achieved. Florida has more than 47,000 properties that are subject to these increases, including vacation rental properties that support the state’s tourism industry.

Know the Facts

FAC has compiled a detailed list of NFIP Policies by State. To view that list, please click here.

FAC has compiled a list of NFIP Losses by State. To view that list, please click here.

For more NFIP Policy Data, Federal Emergency Management Agency has compiled a list of Repetitive Losses / BCX Claims in the state of Florida. To view this list, please click here.

FAC and the NACo have compiled a summary of the Homeowner Flood Insurance Affordability Act and a summary of the key provisions in the Senate and House measures.

Additional Resources

FAC has compiled an NFIP Reauthorization Policy Paper, Talk Sheet, and a Florida NFIP Snapshot.

For more information on current legislation filed please watch the House's hearing of the bill and the discussion during the House Subcommittee on Consumer Protection and Financial Institutions. In addition, click here to view the components of Senator Menendez's SAFE NFP bill of 2017.

FAC also sent a letter to the U.S. House of Representatives opposing the bill. To view that letter, please click here. In addition, other members of Congress expressed concerns with the bill. To view their letter to Speaker Paul Ryan and Majority Leader Kevin McCarthy, please click here.