Background

Despite general economic improvement, Florida’s affordable housing problem shows no sign of abating. Though difficult to generalize across the state, the combined effects of wage stagnation and increasing cost of construction and land contribute to the problem. At the state level, the Legislature continues to allocate funding earmarked for affordable housing to other priorities; in 2018, $185 million designated for the Sadowski affordable housing fund was allocated to other programs, resulting in about $109 million being spent toward affordable housing programs. The impact of the Federal tax bill in 2017 may also have a negative effect on the affordable housing market by reducing the incentive for corporations to take advantage of low income housing tax credits. One study found that the tax bill alone may reduce the number of affordable housing units produced over the next 10 years by 235,000.

The factor of wage stagnation and the State’s continued reliance on service industry jobs are areas where local governments have limited influence. Local governments have offered an array of solutions in those areas where they traditionally provide leadership: by improving public transportation, adopting inclusionary zoning ordinances, creating flexible zoning codes, and allocating public funds towards affordable housing solutions. However, affordable housing remains elusive to many Floridians and part of the solution is reducing the cost of housing.

Florida’s counties need to continue adopting innovative solutions to make sure that every Floridian has access to affordable housing. Nationwide, local governments are using technology to tackle the structural problems that lead to high housing costs, including the prohibitive expense of constructing large-scale developments, making access to capital for construction easier, and reducing the costs and risks associated with property transactions.

Florida’s counties need to continue adopting innovative solutions to make sure that every Floridian has access to affordable housing. Nationwide, local governments are using technology to tackle the structural problems that lead to high housing costs, including the prohibitive expense of constructing large-scale developments, making access to capital for construction easier, and reducing the costs and risks associated with property transactions.

Finding Efficiencies

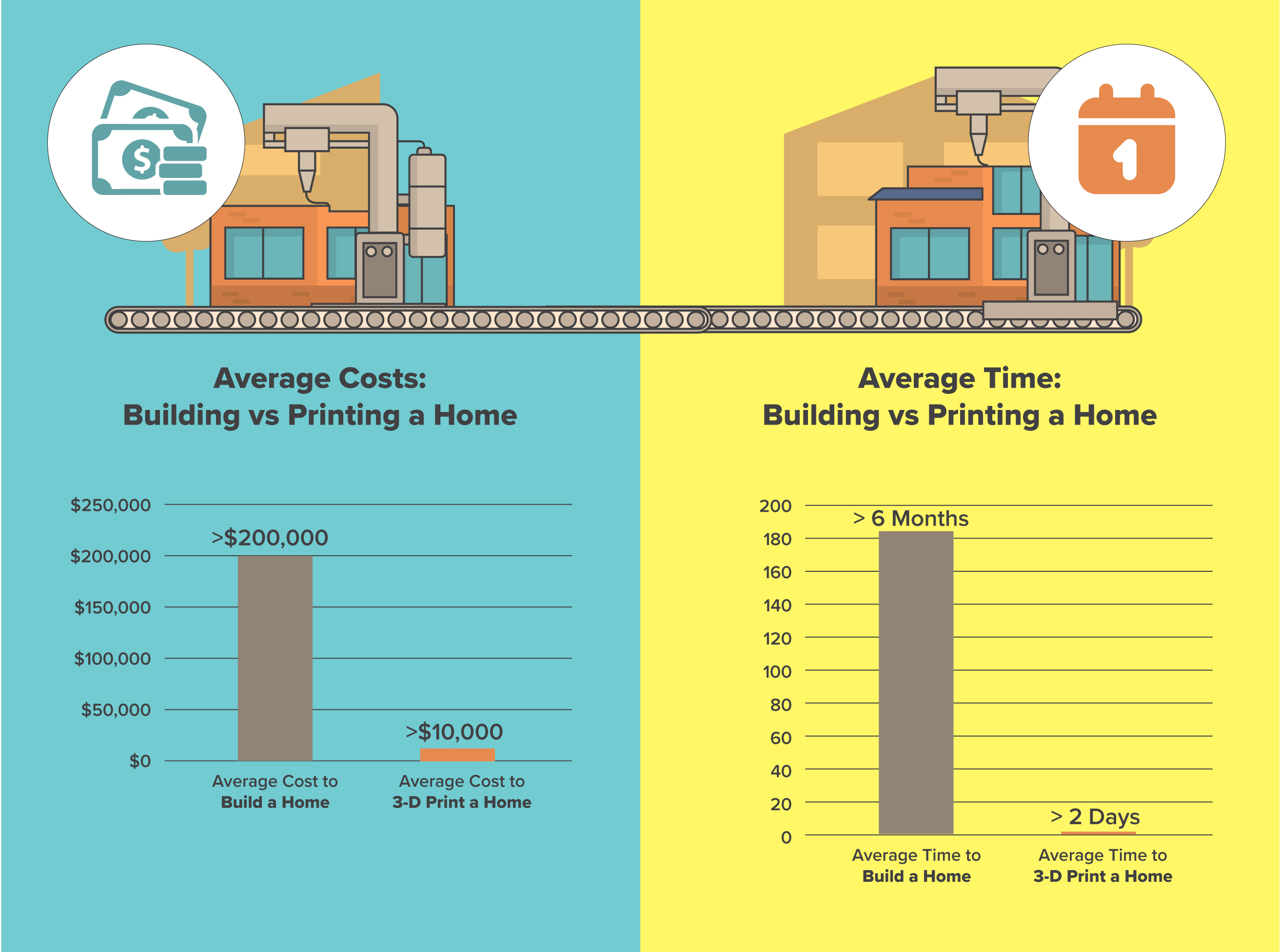

Industrializing construction methods saves developers time and money by making construction by creating efficiencies. According the McKinsey Global Institute, standardizing construction materials and techniques could reduce the cost of construction by 20-30% and reduce the time of completion by 40-50%. Practices such as standardizing structural components, like the lengths of load-bearing elements or specifications for fixtures, can save on procurements costs and can lead to greater productivity among workers. Using prefabricated components manufactured off-site can expedite the time of construction by having parts delivered as needed instead of waiting for them to be constructed on-site. Local governments can encourage projects by creating building codes that enable standardization and scale. 3D printing may also be a technological advancement that contributes to eliminating the affordable housing problem by quickly and cheaply fabricating parts of houses.Using Blockchain to Reduce Transactional Costs

In the future, cryptocurrencies based on blockchain technology may be able to provide funding for public projects, effectively ‘crowd-sourcing’ all types of capital projects. Berkley, California plans to issue its own cryptocurrency to fund affordable housing projects. The cryptocurrency would allow investors to buy shares of city-issued municipal bonds and bypass some of the transactional costs associated with traditional municipal bonds and allow for smaller bond denominations and for investors to buy-in with lower investments. Records of cryptocurrency transactions are stored on a blockchain database – a series of connected computers that store a permanent record of every transaction – and should be more secure than storage on a centralized computer.

Since the cryptocurrency is backed up by a municipal bond, rather than the market, and the rate of return has been set near public rates, the City hopes that value of its cryptocurrency will be immune from value fluctuations that arise from speculation. Until the project is up and running, questions of volatility will remain unresolved, but the big hurdle facing the concept right now appears to be whether there are enough investors that are familiar with cryptocurrency to provide a market for Berkeley’s “initial community offering.”

The blockchain also has the potential to reduce the costs associated with transferring property and to decrease fraud in those transactions. Pilot projects in Arizona, Colorado, Illinois, and Vermont are experimenting with using blockchain to transfer and record interests in real property using the same technology that makes transferring and recording cryptocurrency transactions fast and safe. Because the instrument recording the transaction is imbedded in the means of paying for the property, the need for escrow is eliminated. Also, because the record of the transaction is digitally recorded on the blockchain, the ability to fraudulently convey property, for example by back-dating a deed, is greatly reduced. Decreasing the costs and risks associated with property transactions could yield benefits in a number of ways, for example, redeveloped property is ideal for affordable housing projects but also particularly susceptible to title problems. Minimizing the risk that another party will assert ownership rights means that a problem that might derail a project or create significant additional expenses is avoided.

The blockchain also has the potential to reduce the costs associated with transferring property and to decrease fraud in those transactions. Pilot projects in Arizona, Colorado, Illinois, and Vermont are experimenting with using blockchain to transfer and record interests in real property using the same technology that makes transferring and recording cryptocurrency transactions fast and safe. Because the instrument recording the transaction is imbedded in the means of paying for the property, the need for escrow is eliminated. Also, because the record of the transaction is digitally recorded on the blockchain, the ability to fraudulently convey property, for example by back-dating a deed, is greatly reduced. Decreasing the costs and risks associated with property transactions could yield benefits in a number of ways, for example, redeveloped property is ideal for affordable housing projects but also particularly susceptible to title problems. Minimizing the risk that another party will assert ownership rights means that a problem that might derail a project or create significant additional expenses is avoided.