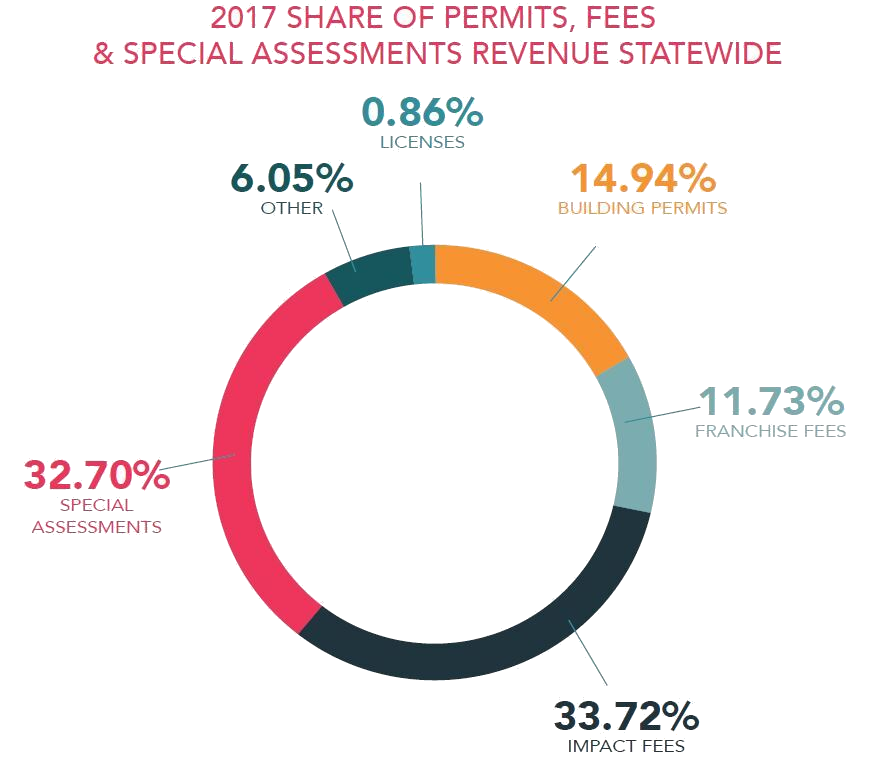

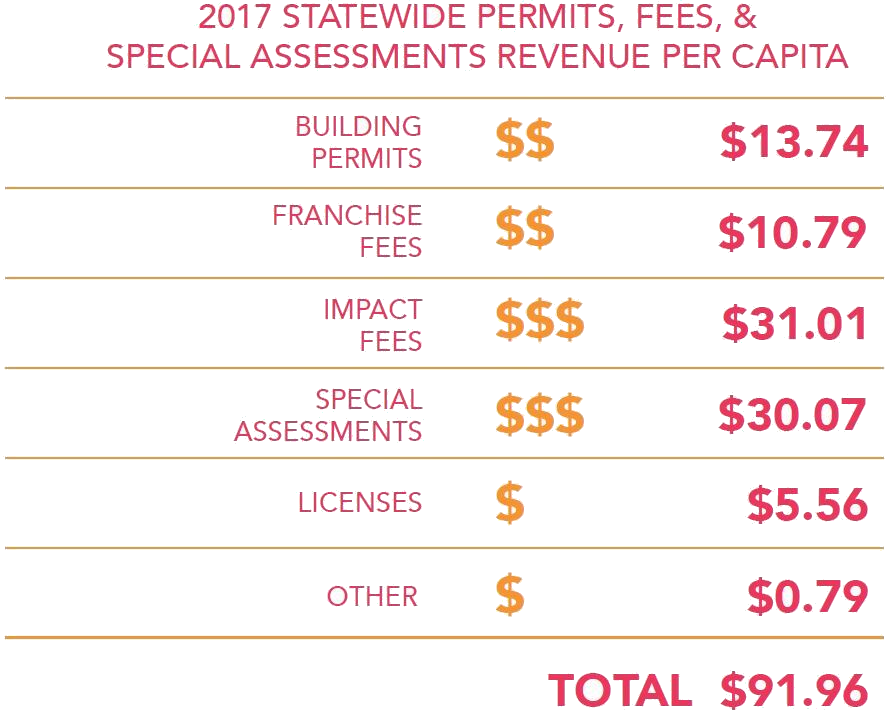

In FY 2017, Permits, Fees, & Special Assessments accounted for 4.07% of all statewide revenues for Florida’s counties, the second smallest revenue category. The statewide average percentage share was equal to 4.7%, when comparing Permits, Fees, & Special Assessments revenues to all revenues on a county-by-county basis. The total per capita receipts for Permits, Fees, & Special Assessments revenues was equal to $91.96 per person statewide.

The majority of Permits, Fees, & Special Assessments revenues was concentrated within two revenue categories statewide: Impact Fees and Special Assessments revenues. These two revenue categories accounted for about 66% of total Permits, Fees, & Special Assessments revenues, $61.08 in per capita revenue for FY 2017.

About a third of all Permits, Fees, & Special Assessments revenues collected (33.72%) were for Impact Fees. The total per capita receipts for Impact Fees revenues was $31.01. Impact Fees revenues provide resources to help counties off set strain on local infrastructure due to new development.

The majority of Permits, Fees, & Special Assessments revenues was concentrated within two revenue categories statewide: Impact Fees and Special Assessments revenues. These two revenue categories accounted for about 66% of total Permits, Fees, & Special Assessments revenues, $61.08 in per capita revenue for FY 2017.

About a third of all Permits, Fees, & Special Assessments revenues collected (33.72%) were for Impact Fees. The total per capita receipts for Impact Fees revenues was $31.01. Impact Fees revenues provide resources to help counties off set strain on local infrastructure due to new development.

About another third of all Permits, Fees, & Special Assessments revenues (32.72%) were collected for Special Assessments. The total per capita receipts for Special Assessments revenues was $30.07. Special Assessments revenues include fees charged on certain properties that would defray the cost of a special capital improvement or service presumed to be of general benefit to the public and special benefit to the assessed properties.

Building Permits receipts accounted for the third highest revenue category at 14.94%, while Franchise Fees follow at 11.73% of statewide Permits, Fees, & Special Assessments revenues. The total per capita receipts for Building Fees revenues was $13.74 and $10.79 for Franchise Fees. Building Permits are imposed on the stated regulatory activities regarding development under home rule powers. Franchise Fees revenue accounts for receipts associated with granting privileges, services, or special benefits to an entity such as a fee imposed on a utility for the privilege of using a local government’s rights-of-way.

Building Permits receipts accounted for the third highest revenue category at 14.94%, while Franchise Fees follow at 11.73% of statewide Permits, Fees, & Special Assessments revenues. The total per capita receipts for Building Fees revenues was $13.74 and $10.79 for Franchise Fees. Building Permits are imposed on the stated regulatory activities regarding development under home rule powers. Franchise Fees revenue accounts for receipts associated with granting privileges, services, or special benefits to an entity such as a fee imposed on a utility for the privilege of using a local government’s rights-of-way.

The revenue categories of Licenses and Other Permits, Fees, & Special Assessments receipts collectively accounted for 6.91% of the total Permits, Fees, & Special Assessments revenues. The total per capita receipts for Licenses and Other Permits, Fees, & Special Assessments was $5.56, and $0.79 respectively. Licenses revenues account for business and contracting licenses. Other Permits, Fees, & Special Assessments revenues include, but are not limited to, inspection, stormwater, and vessel registration fees.